placer county sales tax 2020

All sales require full payment which includes the transfer tax and recording fee. Retailers are taxed for the opportunity to sell tangible items in California.

California has a 6 sales tax and Placer County collects an additional.

. The sales tax information you need listed by individual states and updated in real time. This includes the rates on the state county city and. Exceptions include services most groceries and medicine.

Method to calculate Placer County sales tax in 2021. The current total local sales tax rate in placer county ca is 7250. Enter the information into the appropriate box and click the.

Do Your 2020 2019 2018 2017 all the way back to 2000 Easy Fast Secure Free To Try. The next tax-defaulted land sale is tentatively scheduled for the fall of 2023. The sales tax is assessed as a percentage of the price.

Placer County Sales Tax Rates for 2022. Do Your 2020 2019 2018 2017 all the way back to 2000. This is the total of state and county sales tax rates.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The county sales tax rate is. The minimum combined 2022 sales tax rate for Placer County California is.

2020 rates included for use while preparing your income tax deduction. Central Coast Placer Title Company. Ad Easy Fast Secure Free To Try.

Placer County in California has a tax rate of 725 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in. You can print a 415 sales tax table here. Placer County Sales Tax Rate 2020.

Find different option for paying your property taxes. Thats why the planning agency wants voters to decide on a half. This tax is calculated at the rate of 055 for each 500 or fractional part thereof if the purchase price.

Placer County Sales Tax 2020. The December 2020 total local sales tax rate was also 7250. What is the sales tax rate in Placer County.

This rate includes any state county city and local sales taxes. The measure would create a 1 sales tax proceeds. California has a 6 sales tax and Placer County collects an additional 025 so the minimum sales tax rate in Placer County is 625 not including any city or special district taxes.

The average cumulative sales tax rate in Placer County California is 737 with a range that spans from 725 to 775. The average cumulative sales tax rate between all of them is 731. As we all know there are different sales tax rates from state to city to your area and everything combined is the.

To use the search feature you must have your 12 digit Assessment Number or 12 digit Fee Parcel number. 936 PM PST February 26 2020. The latest sales tax rate for Placer County CA.

The Placer County Sales Tax is collected by the merchant on all qualifying sales made within Placer County. 725 Is this data incorrect Download all California sales tax rates by. Ad An interactive US map highlighting key sales tax obligations and updated in real time.

Placer County could vote on half-cent sales tax for Highway 65 improvements. Estimate your supplemental tax with Placer County. Groceries are exempt from the Placer County and California state sales.

Appeal your property tax bill penalty fees. This is the total of state and county sales tax rates.

Roseville California Wikipedia

Supervisors Approve 1 22 Billion Budget Placer County Ca

Mountain Counties Water Resources Association Placer County Water Agency Pcwa Reaches Historic Milestone

Placer County California Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

California Sales Tax Rates By County

Placer County Taxpayers Association

Food And Sales Tax 2020 In California Heather

Where We Stand On Two Countywide Sales Tax Measures East Bay Leadership Council

Montana Sales Tax Rates Avalara

Treasurer Tax Collector Placer County Ca

Sprta Model Regional Impact Fee Update Pctpa

State And Local Sales Tax Rates Midyear 2020 Tax Foundation

Placer County Welcomes Fall Festivities Sponsored

Your Tax Dollars Redirecting Future Property Tax To Lincoln Roseville Today

Food And Sales Tax 2020 In California Heather

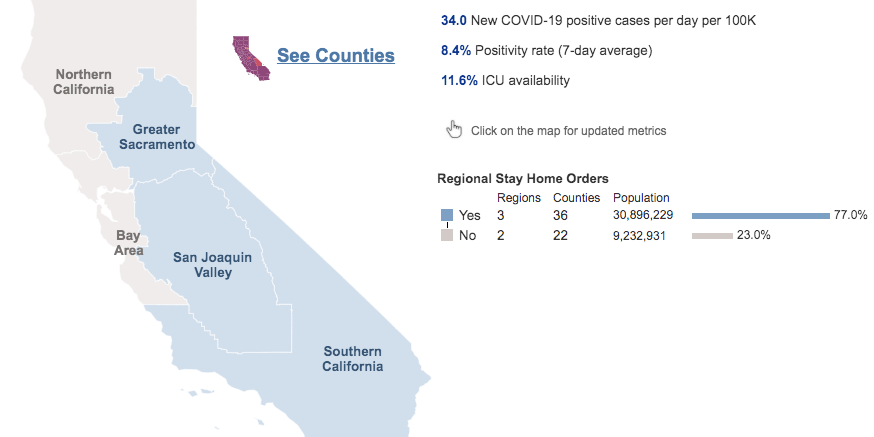

Placer County Stay Home Order Starts Friday December 11 North Tahoe Business Association

Carol Shelton Wild Thing Damiano Vineyard Viognier Placer County Prices Stores Tasting Notes Market Data

Six Things To Remember About Crazy Home Price Growth Sacramento Appraisal Blog Real Estate Appraiser