take home pay calculator manitoba

Back to Top. Personal Income Tax Calculator - 2022 Select Province.

CTC - tax - EPF contribution 10L - 78000 - 21600 Rs.

. This compares to an average annual salary in Canada of 48700 per year for that same age group. If you make 52000 a year living in the region of Manitoba Canada you will be taxed 16332. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual.

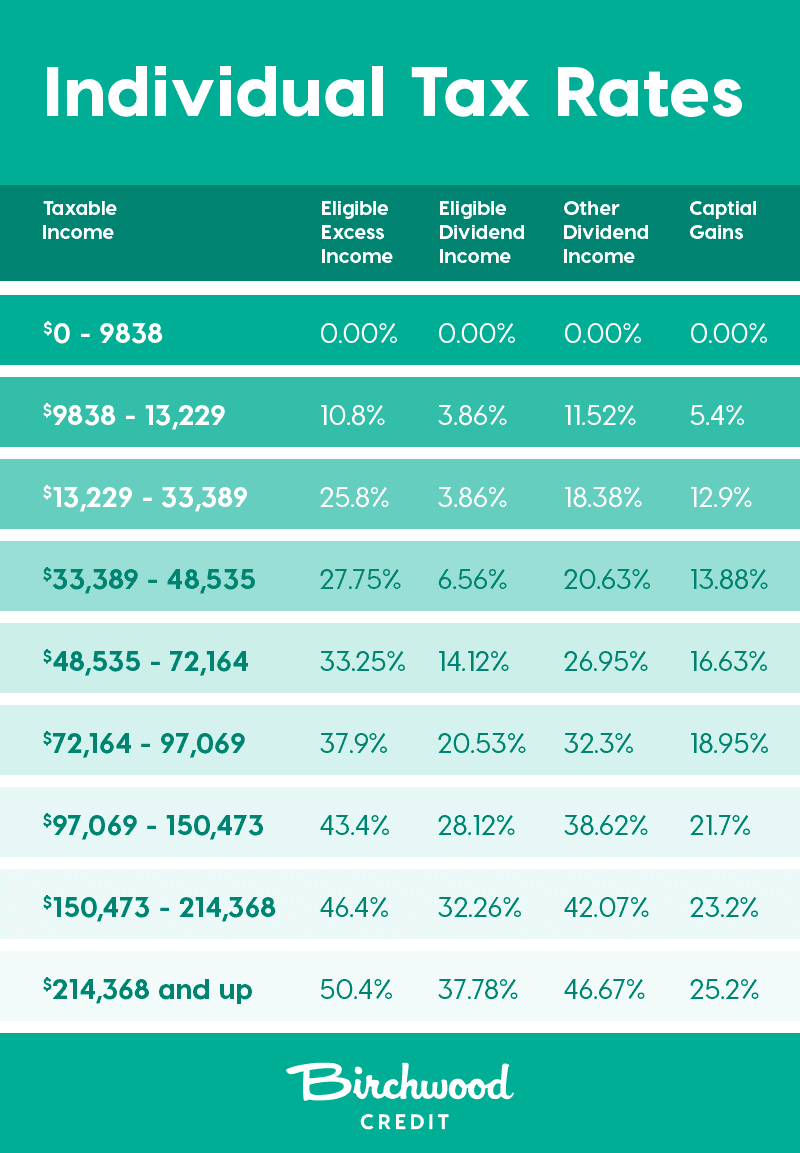

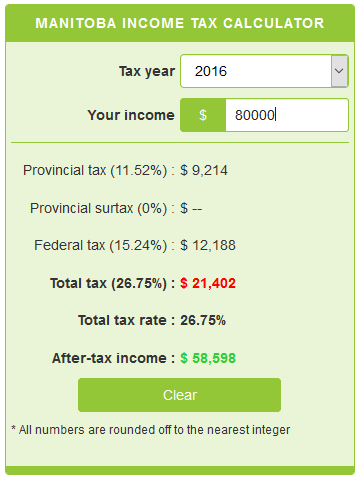

Learn about Manitoba tax brackets in 2021 and 2022. Your average tax rate is 220 and your marginal tax rate is 353. If you would like to know the required gross income for a specific annual take home pay amount enter the target take home pay here and the calculator will determine the gross pay required to generate that take home pay.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services. It will confirm the deductions you include on your official statement of earnings.

The average annual salary is 45300 for workers over 16 years old in Manitoba. The net annual take-home salary as per new tax regime will therefore be. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

Take Home Pay Calculator by Walter Harder Associates. Income Tax Calculator Manitoba 2021. Enter the number of hours worked a week.

With Advanced payroll well even take care of the filings. This makes it easier for an employee to know the amount heshe would have at hisher disposal. You assume the risks associated with using this calculator.

Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location. The Manitoba Income Tax Salary Calculator is updated 202223 tax year. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

To calculate your yearly taxable income multiply your monthly salary by 12 and. That means that your net pay will be 40568 per year or 3381 per month. Income Tax calculations and RRSP factoring for 202223 with historical pay figures on average earnings in Canada for each market sector and location.

Ontario Manitoba Saskatchewan Alberta British Columbia Northwest Territories Nunavut Yukon. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you.

Enter your pay rate. Personal Income Tax Calculator - 2020 Select Province. Please indicate which one of the following roles applies.

Determine taxable income by deducting any pre-tax contributions to benefits Your taxable income is your entire salary including wages tips bonuses and income from other sources that you received in one tax year. Target Take Home Pay. Welcome to the Severance Pay Calculator.

The reliability of the calculations produced depends on the. All Calculators Canada Mortgage Rates Mortgage Calculator Mortgage Affordability Calculator First Time Home Buyer Calculator Closing Costs Calculator Property Tax Calculator Home Value Estimator Cost of Living. That means that your net pay will be 35668 per year or 2972 per month.

This calculator is intended for use by US. Instead of entering that info every time you write a pay cheque you can enter it once and run payroll in a couple clicks with QuickBooks Online plus Payroll. Rent Assist is a monthly shelter-related financial benefit to help low-income Manitobans who pay rent in the private market and who are required to spend a large portion of their income on rent.

This marginal tax rate means that your immediate additional income will be taxed at this rate. British Columbia Alberta Saskatchewan Manitoba Ontario New Brunswick Nova Scotia Prince Edward Island Newfoundland Yukon Northwest Territories Nunavut. Use the button to clear the personal information in order to start again.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. Were bringing innovation and simplicity back into the Canadian payroll market from new ways to pay your employees to our open developer program.

The amount can be hourly daily weekly monthly or even annual earnings. Well calculate the pay and taxes each pay run and keep you ready for year end. If You are looking to calculate your salary in a different province in Canada you can select an alternate province here.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Finitys take-home salary calculator also provides the monthly take-home salary amount along with annual. You can use the calculator to compare your salaries between 2017 and 2022.

Were making it easier for you to process your payroll and give your employees a great experience with their payslips. Your average tax rate is 314 and your marginal tax rate is 384. Theres an easier way.

The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Single SpouseEligible dep Spouse 1 Child Spouse 2 Children Spouse 3 Children. It can also be used to help fill steps 3 and 4 of a W-4 form.

Find out about how much tax you should pay for your income in Manitoba. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Anonymous accurate FREE way to quickly calculate the termination pay severance package required for an Ontario BC Alberta employee let go from a job.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The median salary is 38800. The calculator is updated with the tax rates of all Canadian provinces and territories.

Rent Assist helps Manitobans pay an affordable rent which has been set at 80 of Median Market Rent according to household size. Here is a step-by-step guide to calculating your province net income in Manitoba. The Manitoba Income Tax Salary Calculator is updated 202223 tax year.

Avanti Gross Salary Calculator

Manitoba Tax Brackets 2020 Learn The Benefits And Credits

![]()

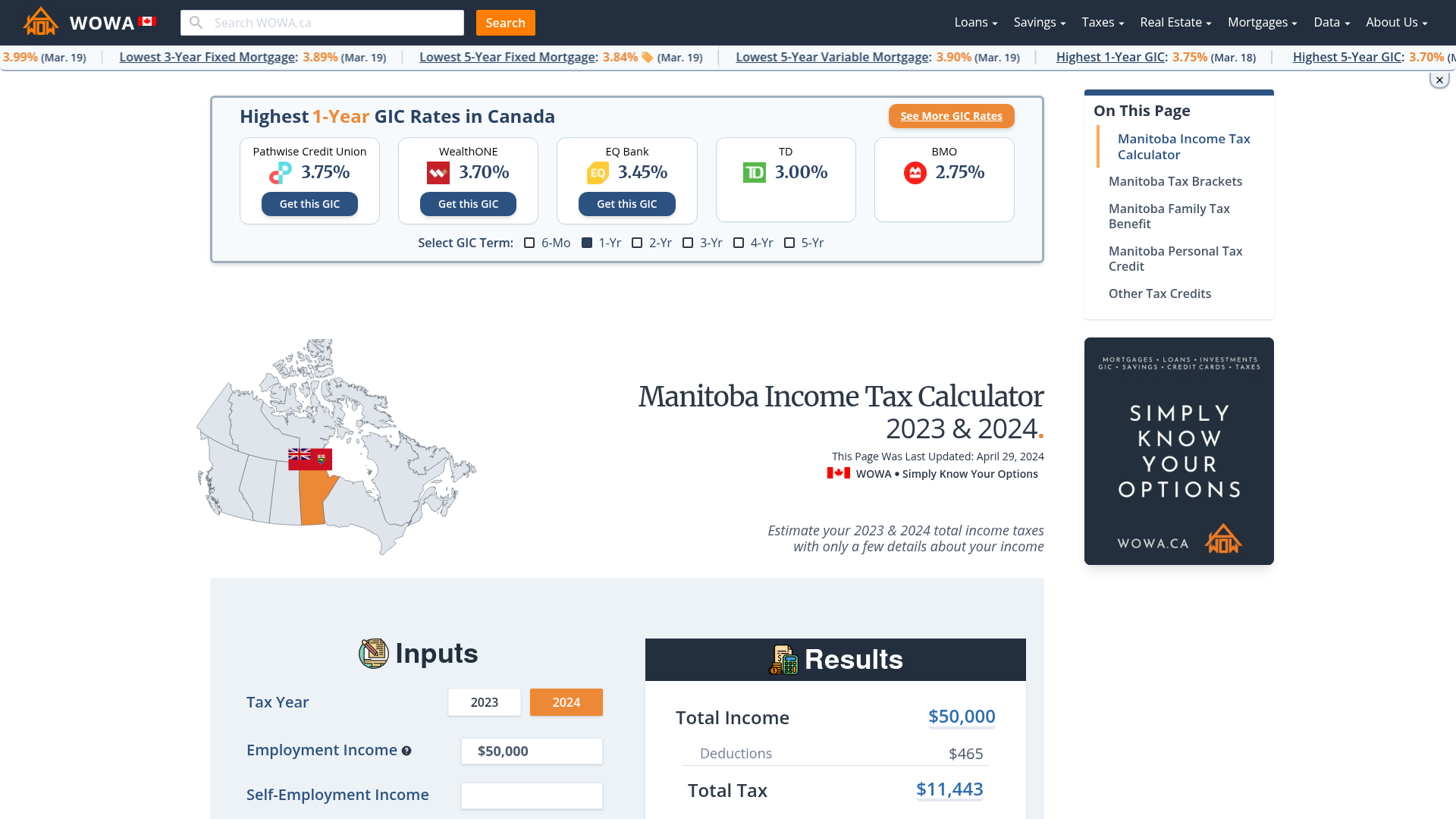

Manitoba Income Tax Calculator For 2022

Calculate Your Net Income Manitoba Give Tax Rates Pensions Contributions And More Income Tax Net Income Income

Manitoba Salary After Tax Calculator World Salaries

Road Trip An Interlake Odyssey Road Trip Road Trip Map Trip

Manitoba Gst Calculator Gstcalculator Ca

Fiba Court Markings Basketball Equipment Specifications Basketball Manitoba Basketball Equipment Basketball Court Measurements Basketball Court

Western Ontario And Mcmaster Universities Osteoarthritis Index Womac Therapy Help Osteoarthritis Mcmaster University

Manitoba Income Tax Calculator Calculatorscanada Ca

Manitoba Property Tax Rates Calculator Wowa Ca

Manitoba Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

![]()

Manitoba Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Taxtips Ca Manitoba 2021 2022 Personal Income Tax Rates

2022 Manitoba Tax Calculator Ca Icalculator

Canadian Income Tax Rules For Entertainment And Meal Expenses Business Tax Rules Tax